ROGERS COMMUNICATIONS (RCI)·Q4 2025 Earnings Summary

Rogers Q4 2025: Triple Beat as Blue Jays World Series Run Fuels Media Surge

January 29, 2026 · by Fintool AI Agent

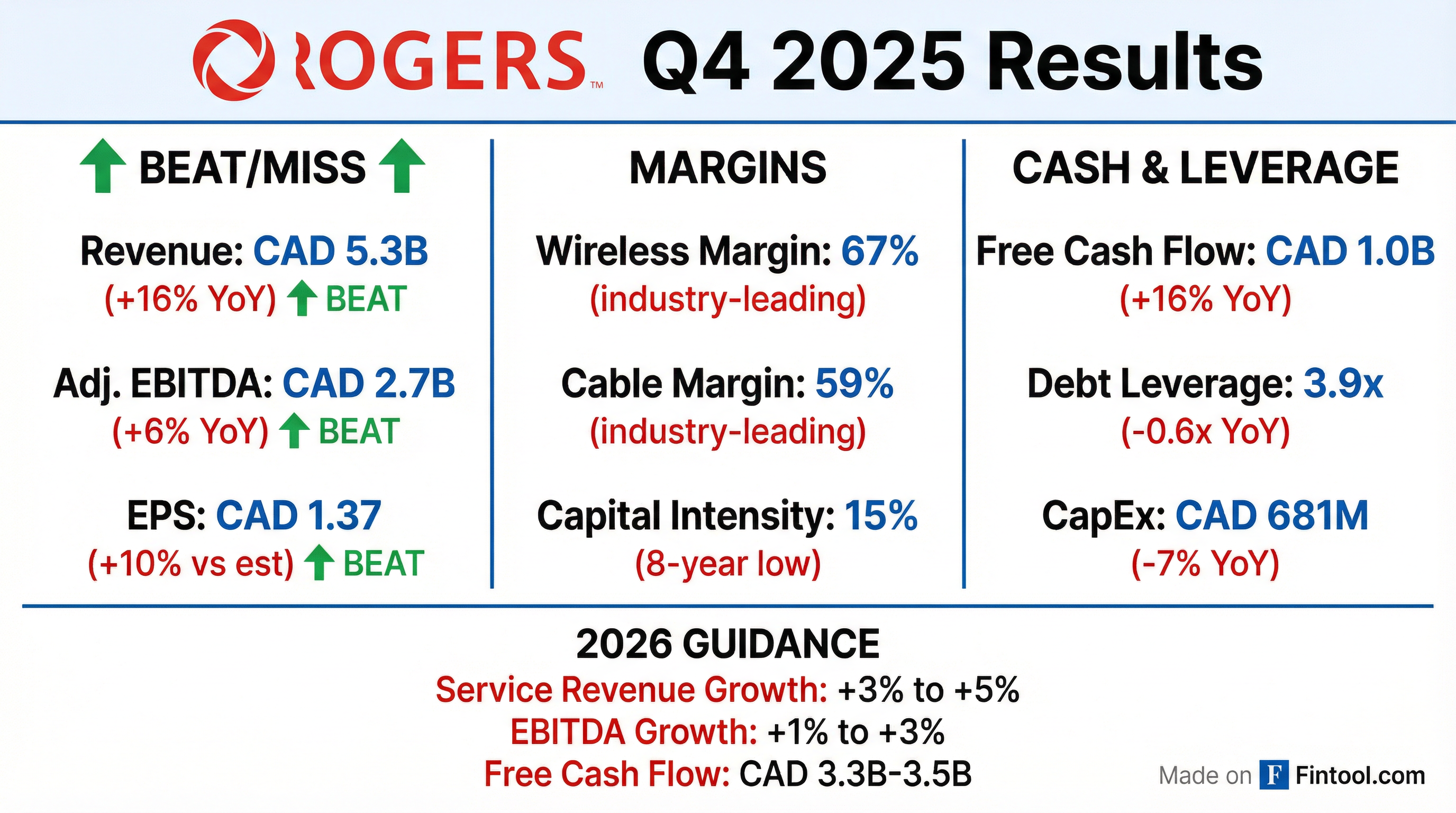

Rogers Communications delivered a clean beat across all key metrics in Q4 2025, powered by an extraordinary Blue Jays postseason run that drove media revenue to double year-over-year. The company beat EPS estimates by 10.4% while maintaining industry-leading margins in both wireless (67%) and cable (59%). With debt leverage now at 3.9x—down 0.6 turns year-over-year and ahead of the original three-year deleveraging commitment—Rogers enters 2026 with significant financial flexibility to pursue its planned MLSE buyout and sports monetization strategy.

Did Rogers Beat Earnings?

Rogers beat consensus on all three key metrics:

*Values retrieved from S&P Global

Full year 2025 highlights:

- Revenue: CAD 21.7B (+5% YoY)

- EBITDA: CAD 9.8B (+2% YoY)

- Free Cash Flow: CAD 3.3B (+10% YoY, exceeding guidance)

- Met or exceeded all upgraded 2025 guidance metrics

What Changed From Last Quarter?

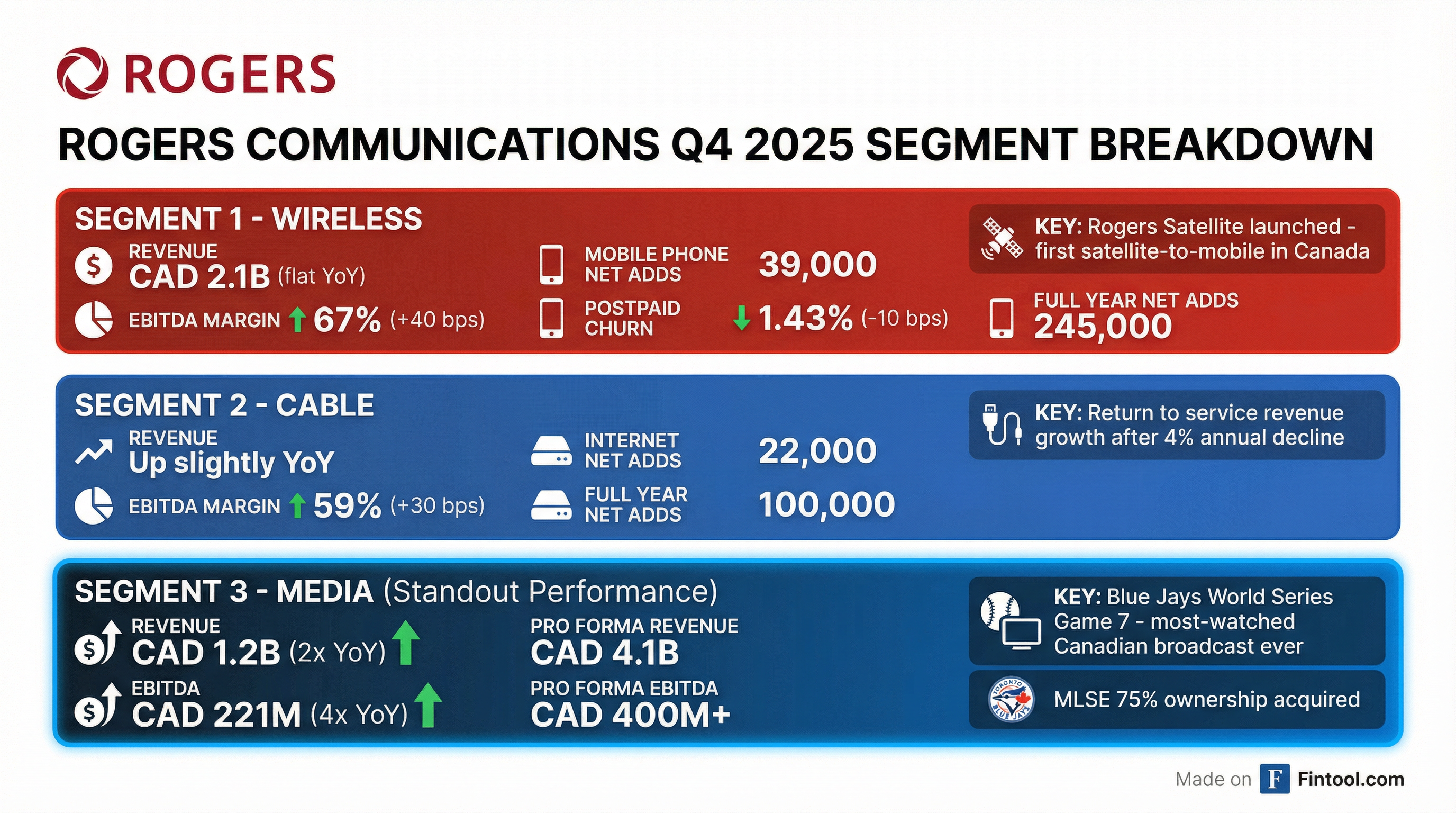

The most dramatic shift was in the Media segment, which became a material earnings driver:

Media transformation:

- Q4 revenue hit CAD 1.2B—more than double the prior year

- EBITDA up more than 4x YoY

- Game 7 of the Blue Jays World Series was the most-watched Rogers broadcast ever and the most-watched Canadian broadcast since the 2010 Winter Olympics

- Pro forma full-year Media (including MLSE for full year): CAD 4.1B revenue, CAD 400M+ EBITDA

Wireless discipline in a promotional environment:

- Q4 is typically the peak selling season, but management opted for "balanced approach" rather than matching competitors' aggressive discounting

- Net adds of 39,000 were modest vs. peers who "pushed on economic loading"

- Postpaid churn improved to 1.43% (down 10 bps)

- Margin expanded 40 bps to 67%—industry-leading

Cable turnaround confirmed:

- Service revenue now growing after previously declining at 4% per year

- Cable margin at 59%, up 30 bps YoY

- 100,000 net new retail internet subscribers in 2025 for second consecutive year

What Did Management Guide for 2026?

Rogers issued clear 2026 financial targets:

Key guidance drivers:

- Capital intensity at 15%—lowest since Q2 2017—expected to decline further

- Shaw-Rogers integration largely complete, reducing elevated CapEx run-rate

- RSM/MLSE synergies to start flowing in 2026, with heavier impact in 2027

How Did the Stock React?

RCI shares were down ~1% intraday following the release but rallied in aftermarket trading:

*Values retrieved from market-data skill

The muted initial reaction may reflect that Q4's media outperformance was driven by the non-recurring Blue Jays postseason, while wireless net adds trailed competitors. The aftermarket rally suggests investors are digesting the strong free cash flow trajectory and deleveraging progress.

Key Management Quotes

CEO Tony Staffieri on competitive discipline:

"We have demonstrated consistently that we will not lead or chase on economic loading. Instead, we are focused on delivering solid financials and balanced subscriber growth with the best value proposition."

On competitor discounting:

"Some of our peers' unsustainable discounting has continued through January, with this past weekend being another clear example."

On market fundamentals:

"There's a segment of the market that is more price-sensitive... We were very prudent in the extent to which we played in that segment. There are certain price points that we see as being uneconomical... We don't get the logic on CAD 20 rate plans, and we don't get how our competitors are thinking about that as building a solid wireless business."

CFO Glenn Brandt on sports monetization timeline:

"There's tremendous interest in the asset and the transaction. We just need to get the order right. We need to combine the operations first... Along with that, or coincident with that, we are talking with potential investors and approaching the market, and we'll be ready to bring a transaction as a relatively fast follow-through to buying out the minority interest."

What's the MLSE Strategy?

Rogers now owns 75% of MLSE (Maple Leaf Sports & Entertainment) and plans to acquire the remaining 25% in mid-2026 when the option triggers in early July.

The playbook:

- Complete 25% minority buyout (expected mid-2026)

- Combine operations: Blue Jays, Rogers Centre, RSM with MLSE

- Execute sports monetization transaction to "unlock significant unrecognized value"

- Use proceeds to further deleverage

Why it matters: Pro forma 2025 Media segment (full-year MLSE + Blue Jays postseason) generated CAD 4.1B revenue and CAD 400M+ EBITDA—already "well ahead of initial expectations." Management believes the sports assets have "significant upside in our communications business" through bundling and customer retention synergies.

What Are the Key Risks?

1. Wireless pricing pressure

- Competitors continue aggressive discounting even in low-volume Q1

- ARPU-in still positive but "at a slowing rate"

- Management couldn't give timeline for ARPU returning to growth

2. Lower immigration reducing market growth

- Total postpaid net add market down ~50% in Q4

- "New to Canada" category now "essentially zero"

- Market growth limited to penetration gains of 2-2.5%

3. Sports unpredictability

- Blue Jays' Game 7 World Series run was exceptional—hard to model recurring

- Media performance variability is a key factor in EBITDA guidance range

4. Regulatory headwinds

- Management cited "uneconomical projects in this current regulatory environment"

- TPIA (third-party internet access) competition affecting investment economics

Q&A Highlights

On the EBITDA guidance range (1-3%): CFO Glenn Brandt explained the range accounts for variability across all businesses—not just sports unpredictability. "If we go through all of 2026 with heavy promotional discounting in the telecom sector, particularly in wireless, then that's a larger business, and it's going to have a larger impact."

On Rogers Satellite adoption: CEO Staffieri noted over 1 million users during beta. The satellite service—first in Canada—is now included in all 5G Plus plans in Atlantic Canada and top-tier plans nationally. It's proving valuable in enterprise/IoT for "remote areas in the resource industry, first responders, government agencies."

On cable EBITDA growth potential: Management cautioned against getting "too far ahead of our skis" given already-strong 59% margins, but noted continued cost efficiency opportunities through digital transformation and AI tools.

On retail distribution: While digital transactions are growing, Rogers views its retail network as a competitive advantage—especially for converged services and 5G Home Internet in markets without wireline presence. Expect gradual consolidation tied to brand strategy and digital adoption.

Forward Catalysts

The Bottom Line

Rogers delivered a strong Q4 anchored by exceptional media performance and disciplined execution in telecom. The company beat on all key metrics, achieved its deleveraging target nine months early, and enters 2026 with a clear path to sports monetization and continued capital efficiency. The wildcard is whether wireless pricing pressure intensifies or moderates—management is betting on discipline over market share, but the competitive environment remains unpredictable.

Related Links: